Realize Financial Goals by Leveraging the Finance Function

Leon SacksIs it inconceivable that:

- one hour of each attorney’s weekly billable time cannot be billed; or

- markdowns of 3% of the value of time worked occur when finalizing billing?

In a typical firm, either of these seemingly minimal adjustments would result in a reduction of about 10% in profits.

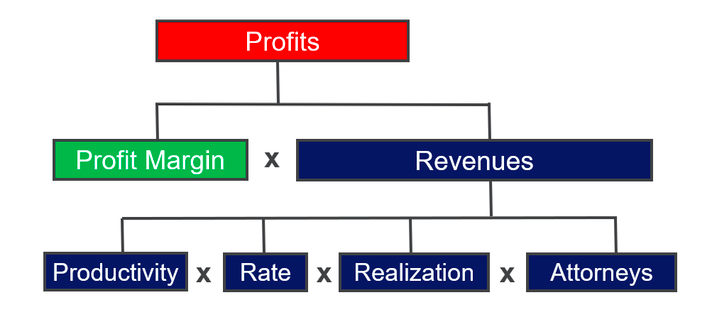

In the familiar profitability model (see figure below), realization has taken on a pivotal role. Realization in this context is the ability to actually bill and collect the value of billable time (billable hours x rate).

While management of attorney headcount and their productivity is important, the data is readily available using standard financial reports. However, managing realization is not as simple a task, and indeed in larger law firms with diverse practices it can become quite complex.

Difficulties in projecting and managing realization generate inherent risks which should concern management, given the potential impacts on profitability. I have frequently witnessed excessive optimism in projections of realization resulting in unfortunate surprises at year-end. The causes include:

- Inherent confidence based on historic trends;

- Reliance on the forecasts/input of billing partners;

- Lack of precision in engagement letters (terms of engagement);

- Inadequate data/information on matter status (including time recorded);

- Lack of oversight and a disciplined management process.

Law firms have taken it upon themselves to address this issue, but with varying degrees of conscientiousness. Some firms, especially the larger firms, have invested in sophisticated financial analysis and in legal project management tools to better evaluate and predict the financial outcome of matters.

According to the 2019 Report on the State of the Legal Market, issued jointly by Georgetown University Law Center and Thomson Reuters, realization against standard rates for a sample of AmLaw 100, AmLaw Second Hundred, and mid-size firms has consistently fallen over the last ten years to less than 84% in 2018 (81.1% for the AmLaw 100 segment). More significantly, excluding discounts and measuring realization against negotiated rates, realization was reported to be below 90% in 2018. There is still a gap of 10% between expected and actual realization.

In a highly competitive market where the parameters for financial terms of engagement are increasingly based less on hours worked (e.g., fixed fees, capped fees, value-based billing and hybrid approaches), it is crucial for firms to negotiate fee arrangements based on reliable cost estimates and manage matters in a disciplined manner to achieve the level of profitability desired.

This challenge has resulted in the trend of hiring professionals dedicated to “pricing” and “legal project management”.

The role of the financial function remains paramount in supporting strategic decision-making and assuring pro-active financial management. The financial function should act as a “watchdog” in assuring accountability, compliance with policies, and alignment with firm strategy that are essential to achieving financial goals. In the case of realization, this may involve

- reviewing the impacts of discounts and non-standard financial arrangements prior to approval by management of the terms of engagement,

- assuring the timeliness of recording hours worked,

- identifying delays in billing and collection, and

- monitoring the financial evolution of matters to identify those that might need management attention and/or remedial measures and to justify write-downs.

The financial function should also act as a “guide dog,” providing support and assistance to all attorneys and other professionals in achieving their goals and maximizing performance. In the case of realization, this may involve:

- providing information to support proposals and negotiations with clients (a joint effort with pricing and knowledge-management professionals, as applicable)

- data and financial models for previous engagements of a similar nature

- financial analysis and simulations of different scenarios with different assumptions (methodology, scope, staffing mix, rates, timing)

- alternative financial strategies/tactics;

- assisting with project management (a joint effort with legal project management professionals, as applicable)

- data on project status and financial projections

- identifying potential solutions (accelerate billings, deal with collection issues).

The leader of the finance function (CFO) must assume both the roles of watchdog and guide dog by engaging with the firm’s partners and leadership teams regularly. The CFO must be empowered by management to be part of the team. (References to such professionals as part of “back office” are pejorative and contrary to their expected contributions to management of the firm and to client teams.)

Today all firms must be prepared to invest in top-class financial professionals who can impact financial performance, making their return on investment (ROI) a “no brainer”. Apart from the given financial knowledge and experience that such professionals should possess, I believe that having the following characteristics are keys to success:

- leadership qualities

- understanding how to be a team player

- ability to engage and influence by building trust

- commercial pragmatism

- persistence in finding solutions and not giving credence to “lip service”

- comfort with technology.

High-level professionals yearn to improve, and may need to accelerate their knowledge to contribute more effectively. Financial professionals who may not have previous experience with the legal sector or feel the need to enhance knowledge on technology solutions require training to enhance their ROI: Law firms should consider such training a priority.

Partners managing the firm, clients and matters are ultimately responsible for decisions that impact profitability. They should enthusiastically support and leverage the financial function in taking the right decisions and realizing their financial goals.

I welcome your comments and questions.